Exactly how to Select the Most Trustworthy Secured Credit Card Singapore for Your Demands

Exactly how to Select the Most Trustworthy Secured Credit Card Singapore for Your Demands

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit Report Cards Following Discharge?

One common concern that occurs is whether former bankrupts can successfully acquire credit score cards after their discharge. The response to this query entails a complex expedition of various factors, from credit score card alternatives customized to this market to the impact of previous monetary decisions on future credit reliability.

Comprehending Charge Card Options

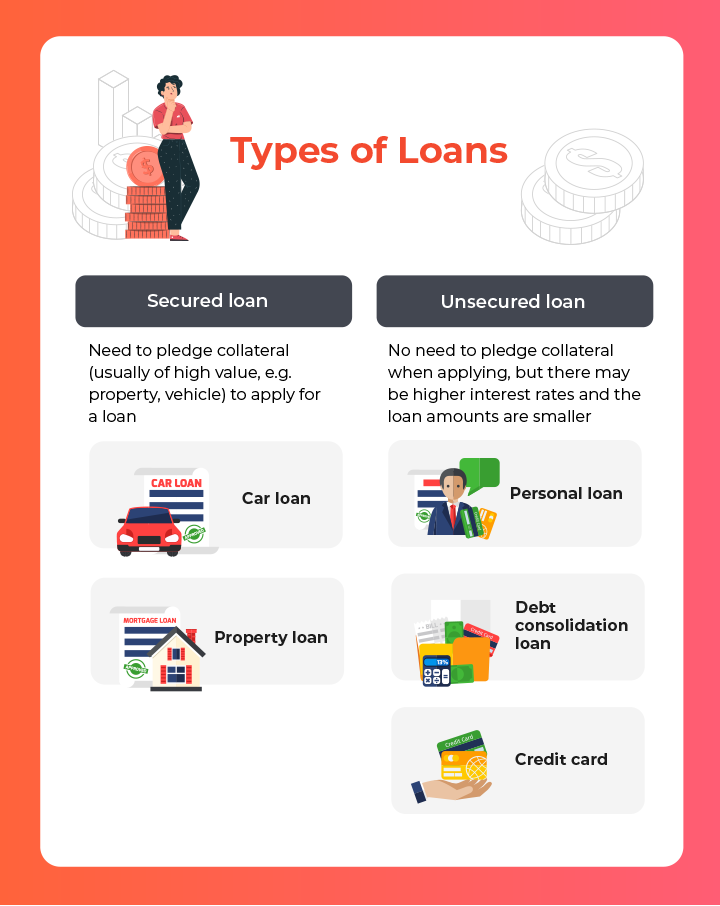

Browsing the world of bank card choices calls for a keen understanding of the varying features and terms available to consumers. When taking into consideration bank card post-bankruptcy, people must meticulously assess their requirements and monetary scenario to choose one of the most appropriate option - secured credit card singapore. Safe bank card, for example, require a cash money deposit as security, making them a viable selection for those looking to reconstruct their credit rating. On the various other hand, unsecured bank card do not demand a deposit yet may feature greater rate of interest and fees.

Additionally, individuals should pay attention to the yearly portion rate (APR), elegance period, annual charges, and rewards programs offered by different bank card. APR determines the cost of borrowing if the balance is not paid in full monthly, while the elegance duration figures out the home window throughout which one can pay the equilibrium without sustaining passion. Additionally, annual fees can impact the overall cost of having a bank card, so it is vital to examine whether the advantages surpass the costs. By adequately reviewing these factors, individuals can make enlightened choices when picking a charge card that aligns with their economic objectives and scenarios.

Elements Impacting Authorization

When applying for credit scores cards post-bankruptcy, comprehending the factors that affect approval is crucial for individuals looking for to restore their economic standing. Complying with a bankruptcy, credit report scores commonly take a hit, making it more challenging to qualify for traditional credit rating cards. Showing liable economic habits post-bankruptcy, such as paying expenses on time and maintaining credit report application reduced, can likewise positively influence credit report card approval.

Safe Vs. Unsecured Cards

Protected debt cards require a money down payment as security, generally equal to the credit history restriction expanded by the provider. These cards generally provide greater debt limits and lower interest rates for people with excellent credit scores. Ultimately, the option between protected and unprotected credit report cards depends on the person's economic scenario and credit goals.

Structure Credit Report Responsibly

To effectively restore debt post-bankruptcy, developing a pattern of accountable credit history usage is essential. In addition, maintaining credit history card balances reduced family member to the credit history limit can favorably affect credit history scores.

One more approach for developing credit history properly is to keep track of credit records routinely. By examining credit records for mistakes or indicators of identity theft, people can address problems promptly and maintain the precision of their credit score Bonuses background.

Reaping Long-Term Conveniences

Having actually established a foundation of responsible credit management post-bankruptcy, people can currently concentrate on leveraging their boosted credit reliability for long-term monetary benefits. By regularly making on-time settlements, maintaining credit score use low, and checking their credit rating reports for precision, former bankrupts can gradually reconstruct their credit rating. As their credit history raise, they may come to be eligible for far better charge card provides with reduced interest prices and greater credit line.

Enjoying long-term advantages from enhanced credit reliability prolongs past simply debt cards. In addition, a favorable debt account can enhance task leads, as some companies may inspect credit history records official site as part of the employing procedure.

Final Thought

To conclude, previous bankrupt people may have difficulty securing bank card complying with discharge, but there are options offered to help reconstruct credit report. Recognizing the different sorts of credit scores cards, factors influencing authorization, and the value of accountable credit rating card use can help individuals in this circumstance. By selecting the ideal card and utilizing it properly, former bankrupts can progressively boost their credit history and enjoy the long-lasting benefits of having access to credit history.

Demonstrating liable financial habits post-bankruptcy, such as paying bills on time and keeping credit history usage low, can likewise favorably affect credit card approval. Additionally, keeping credit report card balances low relative to the credit history restriction can positively impact credit scores. By continually making on-time settlements, keeping credit history utilization reduced, and checking their credit scores records for visite site precision, previous bankrupts can gradually rebuild their credit report scores. As their credit history scores enhance, they may become qualified for better credit rating card provides with lower rate of interest rates and greater credit report limits.

Recognizing the various types of credit history cards, elements impacting approval, and the importance of liable credit scores card use can help individuals in this scenario. secured credit card singapore.

Report this page